“How to Avoid Lifestyle Inflation and Save More Money”

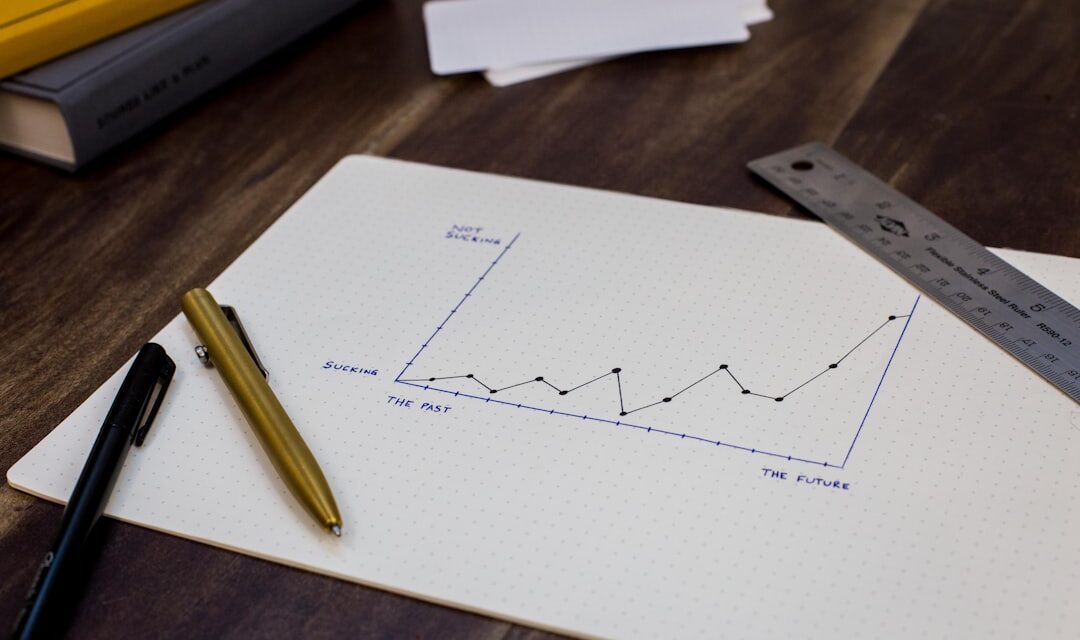

Lifestyle inflation, also known as lifestyle creep, is a financial phenomenon where individuals increase their spending as their income rises. This often occurs gradually over time, with people upgrading their lifestyle to match their new income level. Examples include moving to more expensive housing, purchasing luxury vehicles, or increasing frequency of dining at high-end restaurants following a pay raise.

While it’s natural to desire improved living standards as income grows, unchecked lifestyle inflation can negatively impact long-term financial health. The process can be subtle, with individuals unconsciously feeling entitled to new luxuries and conveniences previously unavailable to them. This can create a cycle of perpetually requiring higher income to maintain an elevated standard of living.

To mitigate the risks associated with lifestyle inflation, individuals should remain aware of their spending habits and prioritize long-term financial stability. By understanding the concept and its potential consequences, people can make more informed decisions about their expenditures and avoid compromising their future financial security for short-term gratification.

Key Takeaways

- Lifestyle inflation is the tendency to increase spending as income rises, leading to a cycle of never feeling financially secure.

- Setting realistic budgets can help individuals prioritize their spending and avoid falling into the trap of lifestyle inflation.

- Avoiding impulse purchases can prevent unnecessary spending and help individuals stick to their budget.

- Finding alternative ways to enjoy life, such as free or low-cost activities, can help individuals avoid the need for excessive spending.

- Investing in assets instead of liabilities can help individuals build wealth and achieve long-term financial security.

Setting Realistic Budgets

Understanding the Importance of Budgeting

Setting realistic budgets can help prevent lifestyle inflation by encouraging people to live within their means and prioritize their financial goals. When creating a budget, it’s essential to take into account current income, expenses, and financial goals.

Categorizing Expenses and Setting Limits

Individuals should identify their essential expenses, such as housing, utilities, food, and transportation, as well as discretionary expenses, like entertainment, dining out, and travel. By categorizing expenses and setting limits for each category, individuals can ensure they’re not overspending in any area and make adjustments as needed.

Staying Honest and Focused on Financial Objectives

Setting realistic budgets also involves being honest with oneself about their financial situation and making conscious choices about where to allocate resources. This can help individuals avoid the temptation of lifestyle inflation and stay on track with their long-term financial objectives.

Avoiding Impulse Purchases

Impulse purchases can be a major contributor to lifestyle inflation, as they often lead to unnecessary spending and can derail an individual’s financial plans. An impulse purchase is an unplanned or spontaneous buying decision, often driven by emotions or external influences. These purchases can range from small, everyday items to larger, more expensive purchases, and can add up over time, leading to increased spending and potential financial strain.

By avoiding impulse purchases, individuals can better manage their finances and reduce the risk of falling into the trap of lifestyle inflation. One way to avoid impulse purchases is to practice mindful spending and be intentional about purchasing decisions. This involves taking the time to consider whether a purchase is truly necessary and aligns with one’s financial goals.

Individuals can also set limits for discretionary spending and establish a waiting period before making non-essential purchases, allowing themselves time to evaluate whether the item is worth the cost. Additionally, creating a list before going shopping and sticking to it can help prevent impulse purchases and keep spending in check. By being mindful of their purchasing habits and avoiding impulsive buying decisions, individuals can reduce the likelihood of lifestyle inflation and maintain better control over their finances.

Finding Alternative Ways to Enjoy Life

Finding alternative ways to enjoy life can help individuals avoid the trappings of lifestyle inflation while still leading fulfilling and enjoyable lives. Many people equate enjoyment with spending money on material possessions or experiences, but there are plenty of low-cost or free activities that can bring joy and satisfaction. For example, spending time outdoors, engaging in hobbies, volunteering, or spending quality time with loved ones are all ways to find happiness without breaking the bank.

By exploring alternative ways to enjoy life, individuals can reduce the pressure to keep up with a lavish lifestyle and focus on what truly brings them fulfillment. Engaging in activities that align with one’s values and interests can provide a sense of purpose and contentment without the need for excessive spending. This can include pursuing creative endeavors, learning new skills, or participating in community events.

By finding alternative ways to enjoy life that don’t revolve around material possessions, individuals can shift their focus away from lifestyle inflation and towards experiences that enrich their lives in meaningful ways. This can lead to greater satisfaction and well-being while also helping individuals maintain control over their finances.

Investing in Assets Instead of Liabilities

Investing in assets instead of liabilities is a key strategy for building long-term wealth and avoiding the pitfalls of lifestyle inflation. Assets are items that hold value and have the potential to generate income or appreciate in value over time, such as real estate, stocks, bonds, or business ownership. Liabilities, on the other hand, are items that require ongoing expenses or depreciate in value, such as consumer goods, car loans, or credit card debt.

By prioritizing investments in assets over liabilities, individuals can build a solid financial foundation and create opportunities for future growth. Investing in assets allows individuals to put their money to work for them and build wealth over time. This can provide a source of passive income and increase their net worth, helping them achieve greater financial security and independence.

By focusing on acquiring assets that have the potential to grow in value or generate income, individuals can avoid the trap of lifestyle inflation and instead build a solid financial future for themselves and their families.

Reassessing Your Financial Goals

Reassessing your financial goals is an important step in managing lifestyle inflation and staying on track with your long-term objectives. As people’s circumstances change over time, it’s essential to periodically review and adjust their financial goals to ensure they remain relevant and achievable. This may involve reevaluating priorities, setting new targets, or making adjustments to their financial plan based on changing needs or circumstances.

By reassessing their financial goals regularly, individuals can stay focused on what truly matters to them and avoid getting caught up in the cycle of lifestyle inflation. Reassessing financial goals also provides an opportunity for individuals to reflect on their values and priorities and make intentional choices about how they want to use their resources. This may involve reprioritizing goals, reallocating resources, or making strategic decisions about saving and investing for the future.

By taking the time to reassess their financial goals, individuals can ensure that they are staying true to their values and aspirations while avoiding the temptation of lifestyle inflation.

Seeking Professional Financial Advice

Seeking professional financial advice can be invaluable for individuals looking to manage lifestyle inflation and make informed decisions about their finances. Financial advisors can provide expert guidance on budgeting, investing, retirement planning, tax strategies, and other aspects of personal finance. They can help individuals develop a comprehensive financial plan tailored to their specific needs and goals while providing ongoing support and advice as circumstances change.

A financial advisor can also offer objective insights and recommendations that can help individuals avoid common pitfalls such as lifestyle inflation and make sound financial decisions. They can provide valuable perspective on how to prioritize spending, allocate resources effectively, and build a solid financial foundation for the future. By seeking professional financial advice, individuals can gain greater confidence in their financial decisions and take proactive steps to manage lifestyle inflation while working towards their long-term financial objectives.

In conclusion, understanding lifestyle inflation is crucial for managing personal finances effectively and avoiding the pitfalls of excessive spending. By setting realistic budgets, avoiding impulse purchases, finding alternative ways to enjoy life, investing in assets instead of liabilities, reassessing financial goals, and seeking professional financial advice, individuals can take proactive steps to manage lifestyle inflation and prioritize long-term financial stability. By being mindful of their spending habits and making intentional choices about how they use their resources, individuals can build a solid financial foundation for themselves and their families while enjoying a fulfilling and meaningful life.

If you’re looking to save more money and invest in your future, you may also be interested in learning how to invest in real estate without owning property. This article provides valuable insights and tips for getting started in real estate investing without the traditional burdens of property ownership. By diversifying your investment portfolio, you can continue to avoid lifestyle inflation and build long-term wealth.

FAQs

What is lifestyle inflation?

Lifestyle inflation refers to the tendency of individuals to increase their spending as their income rises. This often leads to a higher standard of living, but it can also make it difficult to save money for the future.

Why is lifestyle inflation a problem?

Lifestyle inflation can be a problem because it can prevent individuals from saving enough money for emergencies, retirement, or other long-term financial goals. It can also lead to financial stress if income decreases or expenses increase.

How can I avoid lifestyle inflation?

To avoid lifestyle inflation, it’s important to create a budget and stick to it, even as your income increases. It’s also helpful to prioritize saving and investing, and to be mindful of your spending habits.

What are some strategies for saving more money?

Some strategies for saving more money include automating your savings, setting specific savings goals, tracking your expenses, and finding ways to reduce your discretionary spending.

How can I resist the temptation to increase my spending as my income rises?

Resisting the temptation to increase spending can be challenging, but it can be helpful to focus on your long-term financial goals, avoid comparing yourself to others, and find satisfaction in non-material aspects of life. It can also be helpful to seek support from friends, family, or a financial advisor.